-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

*U.S. indices remain at all-time highs as the government shutdown extends into its sixth day, with markets brushing off political gridlock.

*Incoming Japanese PM Takaichi’s pro-stimulus stance could sustain yen-funded carry trades that underpin equity strength.

*AMD surged 30% above $200 on an OpenAI partnership, fueling a semiconductor rally and reinforcing Nasdaq leadership.

Market Summary:

U.S. equity indices continue to trade at all-time highs, supported by persistent enthusiasm toward artificial intelligence and growing expectations for Federal Reserve rate cuts. The bullish sentiment remains intact despite ongoing political gridlock, as the U.S. government shutdown entered its sixth day with the Senate rejecting both Democratic and Republican funding proposals on October 6, extending the political impasse.

The market impact of domestic political uncertainty appears to be tempered by developments in Japan, where incoming Prime Minister Sanae Takaichi is expected to prioritize fiscal stimulus over central bank tightening. This policy orientation suggests the Bank of Japan will maintain its ultra-accommodative stance, preserving the yen’s role as a key source of global liquidity through carry trade activities. The continued availability of low-cost Japanese funding provides underlying support for U.S. equity valuations.

In corporate developments, Advanced Micro Devices Inc. surged approximately 30% to cross the $200 threshold after securing a significant partnership with OpenAI. The announcement ignited broad-based buying interest across semiconductor and technology shares, contributing substantially to the Nasdaq’s outperformance.

While the government shutdown presents a headwind to economic sentiment and data availability, markets appear to be focusing instead on the dual tailwinds of accommodative global liquidity conditions and transformative technological developments. This selective attention highlights how structural factors may be outweighing near-term political uncertainties in current market pricing.

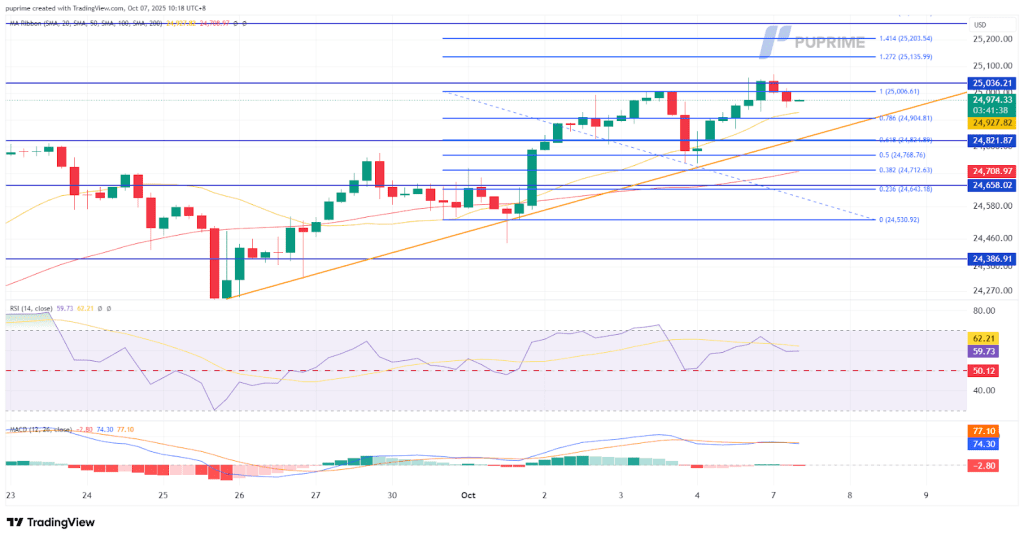

Technical Analysis

The Nasdaq Composite has advanced to a new all-time high, maintaining its position above a key uptrend support line and reinforcing a constructive near-term technical outlook. The index previously underwent a moderate technical retracement but found firm support above the critical 61.8% Fibonacci retracement level—a development that signals underlying strength and suggests the broader bullish trajectory remains well-defined.

The ability to defend this Fibonacci support level is particularly significant from a technical perspective, as it indicates that buyers remain active at higher levels and that the recent pullback represented a healthy consolidation rather than a trend reversal. This pattern of shallow retracements followed by new highs is characteristic of sustainable bullish momentum.

Momentum indicators align with the positive price action. The Relative Strength Index continues to trade above its midline, reflecting persistent buying pressure, while the Moving Average Convergence Divergence remains elevated, confirming that bullish momentum is intact. This configuration suggests that the index has room to extend its gains despite trading at record levels.

Resistance Levels: 25,050.00, 25,260.00

Support Levels: 24,820.00, 24,660.00

Advanced Micro Devices Inc. has extended its remarkable advance, reaching an all-time high of $226.70 amid sustained bullish momentum that has seen the stock more than double from its yearly low. The latest surge, fueled by the company’s strategic partnership with OpenAI, reflects overwhelming investor optimism toward its positioning in the artificial intelligence ecosystem.

The powerful rally has created a significant gap on the price chart—a technical imbalance that often attracts price action for a retest. While gaps following breakouts to new highs can sometimes remain unfilled for extended periods during powerful trends, the current overextended condition suggests an increased probability of near-term consolidation or a partial retracement to fill this void.

Momentum indicators reflect both the strength and potential vulnerability of the current move. The Relative Strength Index has entered overbought territory, indicating intense buying pressure but also signaling that the stock may be due for a pause. Meanwhile, the Moving Average Convergence Divergence shows signs of rebounding above its zero line, confirming the positive momentum shift but also suggesting the rally may be entering a more mature phase.

Resistance Levels: 226.70, 244.40

Support Levels:185.40, 169.25

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!